Life Settlements

Life Settlement

SPV Limited Partnerships: 15%-18% Annual Target Return*

Life Settlement Origination

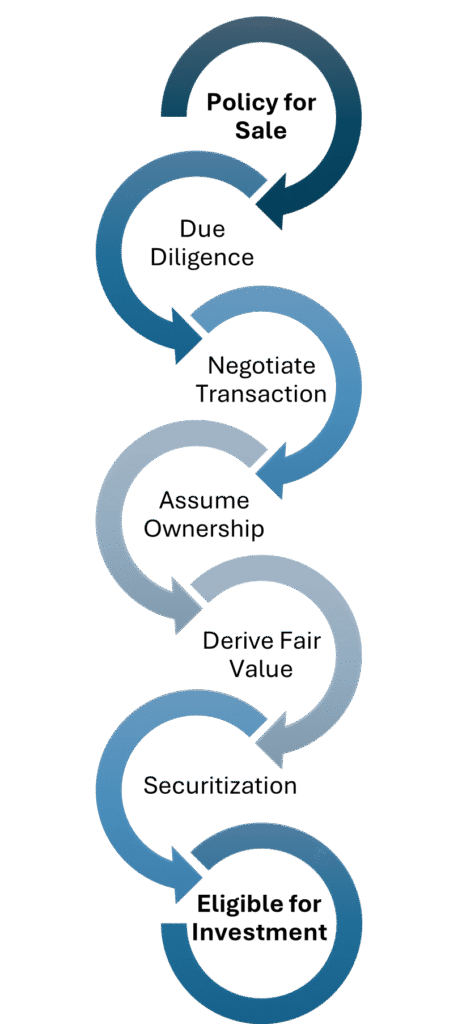

Occasionally, individuals with life insurance policies may reach a point in their life where they no longer find it necessary or affordable to maintain coverage. In these situations they may choose to surrender or let their policy lapse, forfeiting any potential future benefits. A life settlement offers these individuals the opportunity to transfer ownership and beneficiary rights of their policy to a third party buyer in exchange for a negotiated price, through the facilities of a licensed Life Settlement Broker. Momentix sees an exceptional investment opportunity in this space.

Due Diligence

Prior to Purchase: Working with licensed physicians in Canada and the United States, Momentix Capital performs robust due diligence on all policies considered for purchase. The team analyzes the insured’s medical records and policy details and carefully selects the policies offering favourable return characteristics, based on multiple life expectancy estimates.

Taking Ownership: Through our US-based subsidiary, Momentix purchases and assumes full ownership of the life insurance policies and appoints an industry-leading policy servicing company to manage all premium payments, policy administration, and tracking of the insureds.

Pricing: Momentix’s actuarial team then determines a confidence weighted range of Fair Market Values for each policy. These values form the basis from which we derive our offering price to a qualified investor.

Securitization: Upon the maturing of each policy, the SPV Limited Partnership receives the full death benefit, resulting in a significant payout that is distributed to the Limited Partnership’s unitholders. This process is the product of a carefully planned and fully contemplated strategy designed to provide robust, scalable and attractive returns.

Interested in learning more about Life Settlements?

Momentix Capital is interested in speaking with you about this very unique investment product. Please contact us via email or submit a form and we will happily provide guidance specific to your portfolio requirements.